What is the CalPERS Challenge?

Given unfunded pension obligations, our collective challenge (aka The CalPERS Challenge) is: How to effectively secure the solvent financial future of the City, its employees, and its retirees while ensuring the delivery of public services and stewardship of public resources.

What is CalPERS?

The California Public Employees' Retirement System is an agency in the California executive branch that "manages pension and health benefits for more than 1.6 million California public employees, retirees, and their families". Wikipedia

CalPERS Presentations

City Documents, Videos & Upcoming Meetings

City Council

|

CalPERS long term fiscal management |

|

|

FY17/18 set aside $4.5 million in General Fund savings for long-term management of the CalPERS Unfunded Accrued Liability |

|

|

Establishment of the Section 115 Pension Trust |

|

|

Establishment of the Pension Funding Policy |

|

|

Authorize the appropriation of any savings from the MOU with the Riverside and Alvord USDs for cost sharing of crossing guard services to the Pension Stabilization Fund |

|

|

Pension Trust Fund Administration and Investment Management Services |

|

|

Riverside Specific CalPERS actuarial analysis by Bartel & Assoc.; Fiscal Year 2018-19 Financial Report |

|

|

CalPERS unfunded pension obligations long term management |

|

|

Pension Obligation Bonds |

Finance Committee

|

CalPERS retirement system overview |

|

|

CalPERS Long Term Fiscal Management and Options |

|

|

CalPERS Fresh Start Program |

|

|

CalPERS Long Term Fiscal Management Update |

|

|

Priority Based Budgeting; Partnership Compensation Model estimated impacts |

|

|

Section 115 Trust Establishment |

|

|

CalPERS Replacement Benefit Plan; Pension Funding Policy |

|

|

Sale of High Value Assets as a potential solution for CalPERS Challenge |

|

|

Financial Health Indicators |

|

|

CalPERS Cost Saving Measures |

|

|

General Fund Restructuring |

|

|

Pension Obligation Bonds |

Budget Engagement Committee

|

Update on the Long Term Fiscal Management of the City’s California Public Employees’ Retirement System |

|

|

Establishment of Section 115 Pension Trust Fund |

|

|

Pension Funding Policy |

|

|

Estimated Fiscal Impact of Partnership Compensation Model |

|

|

Ad Hoc Committee Update |

|

|

FY 2018/19 Financial Report; Discussion on the 5 Year Spending Program; CalPERS Ad Hoc Update |

Frequently Asked Questions

Defined Benefit Plans (DBPs) are pension plans in which an employee receives fixed benefits that are based on length of service and salary earned at the time of retirement. The City’s relationship with CalPERS to provide a DBP to its employees dates back to 1945 when the initial plan was approved by Riverside voters by Special Election on June 5. Further, the City’s Charter (Article X – Retirement), requires a CalPERS retirement for City employees.

The City has several employee groups with different CalPERS DBP formulas. The formula represents the percent of salary for each year employed with the City that a plan member will receive at or after the specified age. A defined contribution plan (DCP), such as a 401K, is a dollar contribution to a retirement fund. The total retirement in a DCP is generally based on the amount of assets and growth of the money.

Two-thirds of Funds Come from Investments

Historically, more than 60% of all funds paid to CalPERS retirees comes from investment earnings. When CalPERS does not meet its investment return goals, the City will pay more.

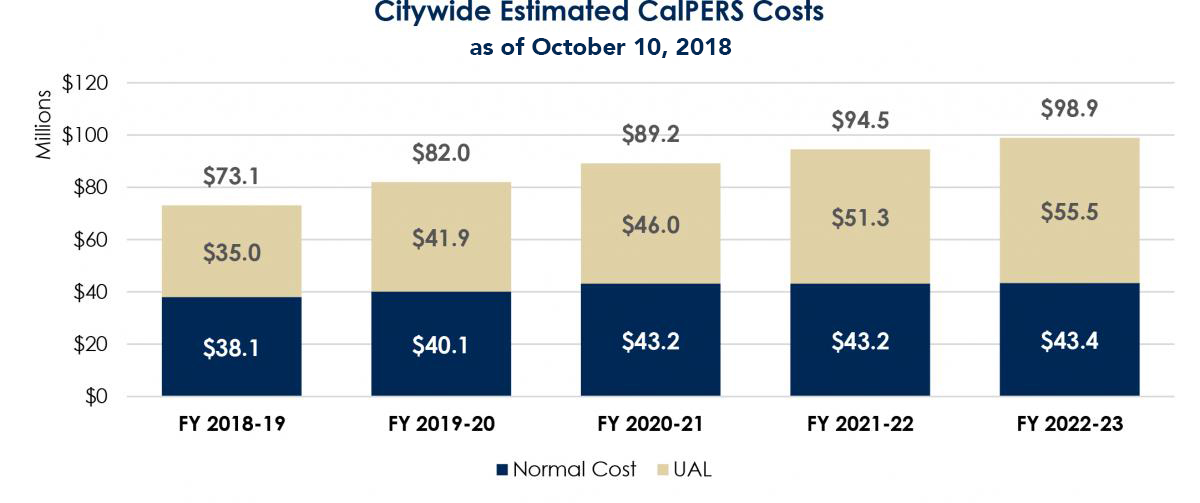

Citywide CalPERS Cost Overview

Over the next five years (FY 2018-19 to FY 2022-23), the City anticipates its annual retirement expenditures to increase by 35.35% from approximately $73.1 million to $98.9 million. The UAL projections are based on the City’s most recent CalPERS actuarial reports dated July 2018 which report data as of June 30, 2017; the normal cost projections are sourced from the adopted FY 2018-2020 Biennial Budget and FY 2018-2023 Five-Year Plans. The information below provides a five-year look at the City’s overall pension costs and pension costs in the General Fund, including Measure Z.

The City’s retirement plans went from having an excess of cash (i.e. super-funded, or funded above 100%) to being under-funded. This is mainly due to investment losses by CalPERS during the Great Recession, which impacted all California agencies’ retirement plans managed by CalPERS. Currently, the City’s CalPERS plans are funded at 78.2% (Miscellaneous) and 73.2% (Safety). Additional factors have also contributed to increasing costs:

- Retroactive retirement benefit enhancements for City employees between 2001 and 2006;

- Long-term investment returns not meeting expectations (e.g. 8.1% over the last five years, 5.6% over the last 10 years, and 6.1% over the last 20 years);

- The resulting changes in the CalPERS anticipated return-on-investment rate over the past 15 years, from 8.25% to 7.00%; and

- CalPERS retirees living longer

As a result of the above factors, which contributed to the decline in overall retirement plan funding levels, California public entities such as the City of Riverside must increase their future payments into the CalPERS system. The payment levels are determined by CalPERS, and they are increasing exponentially.

The City has Taken Several Steps Over the Years to Reduce Pension Costs

- 2003-2004 – The City issued Pension Obligation Bonds to extinguish the Unfunded Accrued Liability at that time, and to reduce future annual payments.

- 2011-2012 – Required all new CalPERS employees (Tier 2) to pay the employee portion of CalPERS pension costs.

- 2013 – Established lower pension benefits for new (PEPRA/Tier 3) employees, resulting in lower pension costs.

- 2016 – Existing employees not currently paying the employee share of CalPERS retirement costs began doing so. Currently, the savings impact of this action are mitigated by the California Rule.

- 2017 – Refinanced $30 million Bond Anticipation Note using Measure Z Funds. Allowed a fixed interest rate for the pension related debt and an accelerated payoff of the principal balance.

- 2018-2020 – Pre-pay the UAL at the beginning of the Fiscal Year to save 3.5% ($1.2 million/year).

- Every Year – Implement operational efficiencies, where possible, to minimize costs and impact to service levels as CalPERS costs increase.

Actuarial Report – An actuarial valuation is a type of appraisal which requires making economic and demographic assumptions in order to estimate future liabilities. The assumptions are typically based on a mix of statistical studies and experienced judgment.

Bond Anticipation Note (BAN) – A short-term obligation that is issued for temporary financing needs. The principal payoff may be covered by a future longer-term bond issue. These notes normally have maturities of one year or less and interest is payable at maturity rather than semi-annually.

California Rule – The California Rule is the result of a 1955 court case (Allen v. City of Long Beach) that concludes that an employee’s pension benefit as of the date of hire constitutes a contractual obligation. The California Supreme Court ruled that “Changes in a pension plan which result in a disadvantage to employees should be accompanied by comparable new advantages”. The 1955 ruling is currently being contested.

Defined Benefit Plan (DBP) – A type of pension plan in which an employer/sponsor promises a specified monthly benefit upon retirement that is predetermined by a formula based on the employee's earnings history, tenure of service and age.

Defined Contribution Plan (DCP) – A type of retirement plan in which a certain amount or percentage of money is set aside each year by a company (or employee) for the benefit of each of its employees. Benefits directly depend upon individual investment returns.

Discount Rate – Also known as the expected rate of return or the assumed rate of return. It is the estimated long-term average return expected to be earned on investments.

Employee Contribution – The portion of normal cost required to be paid by the employee, subject to the local agencies negotiated memorandums of understanding with applicable employee groups.

Employer Contribution – The portion of normal cost required to be paid by the employer, determined by periodic actuarial valuations under state law and based on the agency’s benefit formulas and employee groups covered.

Funded Ratio - Percentage of assets available today to pay all of the pension benefits promised to employees.

Normal Costs – The annual cost of service accrual for the upcoming fiscal year for active employees. The normal cost should be view as the long-term contribution rate for existing employees.

Pension Obligation Bond (POB) – Taxable bond that some state and local governments have issued as part of an overall strategy to fund the unfunded portion of their pension liabilities by creating debt.

PEPRA - Public Employees’ Pension Reform Act of 2013 – A pension reform bill that went into effect January 1, 2013. The bill impacts new public employees and establishes a limit on the amount of compensation that can be used to calculate a retirement benefit.

Superfunded – A term used to describe periods in which total available CalPERS assets exceed the total CalPERS liability.

Unfunded Accrued Liability (UAL) – Portion of the plan’s unfunded liability that is not funded by the plan’s asset value.

The City maintains a strict commitment to collective bargaining which includes the requirement to meet and confer on any changes affecting wages, hours, promotions, benefits, and other employment terms. The City will not engage in activity that may be seen to run counter to the ability of the City and the Unions to communicate openly and honestly during the collective bargaining process, to find solutions that will ultimately benefit the City of Riverside. For simplicity, the City colloquially refers to this commitment as performing in “good faith” with the Unions and unrepresented employees alike.

The City of Riverside is committed to good faith bargaining and therefore cannot comment on suggestions in this subject area. Please refer to “What is good faith bargaining?” at the City’s CalPERS website.

Please provide all the ideas directly in the feedback contact form. All feedback is reviewed.

According to the June 2017 Actuarial Reports provided by CalPERS, the total cost for the City of Riverside to leave CalPERS exceeds $4 billion. The exact amounts can be found in the City of Riverside CalPERS Annual Valuation reports for the Miscellaneous Plan and Safety Plan as of June 30, 2017, of each report under the title “Hypothetical Termination Liability”. Miscellaneous 2017 and Safety 2017

California public agencies that are member agencies with CalPERS face two significant hurdles to replace the CalPERS retirement benefit with a 401k or similar retirement benefit for their current or future employee:

- The “California Rule” does not allow public agencies to reduce the benefits of retired or current members. This ‘rule’ is currently under review with the California Supreme Court.

- In order to offer a new retirement benefit for employees, the public agency will need to make the full exit payment to CalPERS while also funding the replacement benefit program. This means that CalPERS would not be offered to current and new employees and instead be part of a defined contribution retirement plan, like a 401K plan. The total exit payment for the City of Riverside is currently valued by CalPERS at more than $4 billion, according to the June 30, 2017 Riverside CalPERS Annual Valuation reports for the Miscellaneous Plan and Safety Plan.

The City only participates in the Medicare portion of Social Security and Medicare costs are paid half by the employee and half by the employer. This is the default standard for private and public employers, although an employer can choose to pay the employee share. Unlike private employers, the City of Riverside does not offer Social Security to employees.

Employer Paid Member Contributions (EPMC) is a negotiable retirement benefit that allows a CalPERS employer to report the EPMC amount as salary for the employee. These benefits were often negotiated in exchange for raises. For example, a lower raise (or no raise at all) may be negotiated in exchange for the City paying a percentage of CalPERS (EPMC). Both raises and the EPMC are PERSable.

Example: An employee earns $50,000 per year. The employee contribution paid by the City or EPMC is 8% of the employee’s salary, or $4,000. Therefore, the 8% employee contribution is paid by the employer and is reported as additional compensation above the base salary, which results in the employee’s annual salary being reported to CalPERS equal to $54,000.

As a negotiable benefit, EPMC was used to enhance the retirement benefit for all City employees up until 2011, when certain labor unions and City management agreed as part of negotiations to transition Tier 1 classic employees to paying the employee contribution rate defined by CalPERS and gradually eliminating the EPMC benefit altogether.

Yes, the City has current employees with EPMC benefits. This benefit applies to classic Tier 1 employees (hired before 2011) in the Local Miscellaneous group (SEIU, IBEW and Unrepresented) who are paying a portion of the employee contribution with the City continuing to pay the remainder of the employee contribution as EPMC. By the end of 2021, all Tier 1 classic employees in these groups will be paying 100% of the employee contribution and EPMC will no longer be a benefit.

Employees in the Local Safety group (Sworn Fire and Police) continue to have the EPMC benefit in their contracts for Tier 1 classic employees; however, both Fire and Police units agreed to begin paying a portion of the employer contribution starting in 2018. Employee payment of the employer share allows the PERSable base, which includes the EPMC, to remain unchanged, unless agreed by the union and the City. Classic Tier 2 employees for all bargaining units pay 100% of the employee contribution with no EPMC benefit. EPMC benefits are excluded by law for new members (PEPRA) hired after January 1, 2013.

No, the City of Riverside does not offer lifetime medical benefits.

The City of Riverside negotiates with health care providers to provide reduced premium costs for retired employees; however, retirees must pay 100% of the premium. Some bargaining groups have a retiree benefit ranging from $100 - $150 per month to apply to the premiums as negotiated under their labor contract.

As of the latest actuarial valuation of June 30, 2017, the City of Riverside has 2,155 active and 2,880 retired employees.

The CalPERS Golden Handshake is a contractual benefit offering an early retirement incentive to eligible employees. Current law allows for a Golden Handshake to provide an additional two years of service credit. To be eligible, you must retire within the establish time period (usually between 60 to 120 days). An employee would also need to be at least 50 years old and have 5 years of service credit in CalPERS. If an employee retires under a Golden Handshake and then receives unemployment benefits or reinstate from retirement, they will lose this benefit.

In order to offer a Golden Handshake, there must be an impending layoff and the employer must be able to demonstrate that enough savings can be realized to pay for the Golden Handshake benefits. The employer must contract with CalPERS and pay the cost for this early retirement incentive. This process includes a requirement to meet and confer with the represented bargaining units.

There are other types of early retirement incentives that an employer may offer outside of the CalPERS contractual Golden Handshake, including offering a financial lump sum incentive or establishing an annuity. These early retirement incentives are not governed by CalPERS and may have different eligibility requirements as negotiated by the City and the bargaining unit.

The fiscal impact is a complicated calculation to project the long term cost or benefit for this offering. Employer costs include the incentive paid to the employee plus additional costs that the employer will pay to CalPERS for a member that will stop making their CalPERS contributions earlier than expected and instead start to draw against their CalPERS pension. These costs become an unfunded pension obligation in future years. An undetermined amount of offsetting savings could be realized by hiring a replacement employee at a lower salary rate or leaving the position vacant.

A CalPERS retiree may earn more than their final salary depending on several factors including the number of years the member has been with CalPERS and the retirement formula the member has earned with each participating agency.

CalPERS includes an annual cost of living adjustment (COLA). City of Riverside contracts include a maximum of 3% COLA for retirees. Additional detail is available here.

No, overtime and leave balance payouts are not considered salary by CalPERS and do not increase the retirement benefits for employees.

Replacement Benefit Plan (RBP) is a qualified excess benefit arrangement pursuant to Internal Revenue Code (IRC) section 415(m). This plan provides for the replacement of the portion of the retirement allowance that exceeds the IRC section 415(b) dollar limit. Members in the RBP will receive a separate check from the State Controller’s Office. All of the members’ prior CalPERS employers whose service was included in the retirement allowance calculation are invoiced each year the allowance exceeds the limit. Every CalPERS employer is deemed to participate in the RBP in accordance with Government Code section 21761. CalPERS Fact Sheet is available here.

The maximum annual retirement benefit payable is $280,000 for the 2018 calendar year. The maximum amount CalPERS will pay into this is $220,000 for the 2018 calendar year, and the City is responsible for the difference via the RBF program.

No. Article X of the City Charter establishes Riverside as a contracting City under the California Public Employees’ Retirement System (CalPERS). As such, all eligible employees of the City as indicated in the contract between the City of Riverside and CalPERS must participate in PERS and pay contributions as required in their Memorandum of Understanding for represented employees or the Fringe Benefit and Salary Plan for non-represented employees, for as long as the contract is in place.