Finance

FY 2024-2026 BUDGET

Biennial Budget Overview

The City of Riverside adopts a biennial budget and a five-year planning process to provide a more informative, long-term outlook on the city’s finances. This strategic approach allows for a thorough examination, thoughtful planning, and efficient allocation of resources over an extended period. Furthermore, this process provides the flexibility to adapt to changing circumstances, respond to emerging needs, and implement long-term strategies.

The City’s budget is not just a set of numbers – it is a policy document that sets strategic priorities developed in the context of a comprehensive five-year financial plan. Through the budget and five-year financial planning process, the City of Riverside strives to promote transparency, taxpayer accountability, and fiscal strength.

We are proud to note that the City’s budget documents are consistently recognized by national organizations as reflecting the City’s commitment to meeting the highest principles of governmental budgeting, with the budget serving as a policy document, a financial plan, an operations guide, and an effective communications device.

Two-Year Budget Cycle Process

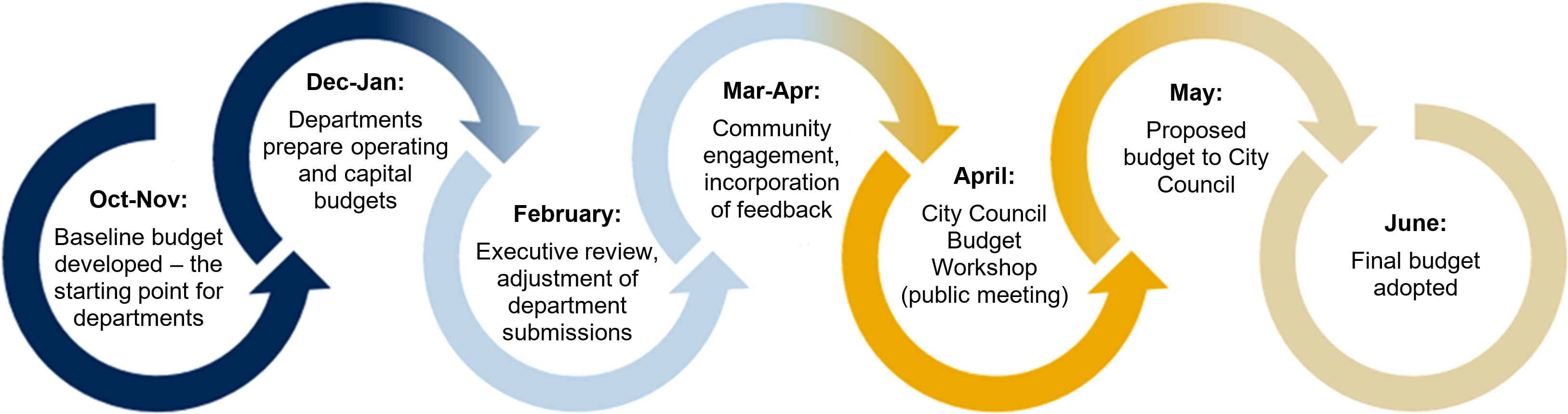

In October 2023, the City initiated the budget development process for the Fiscal Year (FY) 2024-2026 two-year budget, which encompassed FY 2024/25 and FY 2025/26. The initial analysis of budget numbers involved internal and external meetings with key subject matter experts. While the budget process was largely an internal effort through February, community engagement played an essential role. As such, during the months of October and November, the City conducted budget workshops titled “Your Money, Your Voice.” These sessions provided citizens with a presentation on the City’s FY 2023/24 budget allocations, vital programs, and essential services. Staff from the various City departments were also present to answer questions and gain insights into the programs and services that mattered most to the City’s residents. The “Your Money, Your Voice” meetings elicited feedback to understand what services, programs, and facilities Riverside residents deemed most important, as did in-person and online surveys.

FY 2024-2026 Biennial Budget Adoption

On June 25, 2024, the City Council adopted the FY 2024-2026 biennial budget and capital improvement program, directing roughly $1.45 billion each year to crucial needs to promote financial stability and increase the quality of life in Riverside.FY 2024-2026 Biennial Budget Press Release

Priority Based Budgeting (PBB):

In developing the budget, the City utilizes a Priority Based Budgeting methodology that focuses on aligning financial resources with an organization's strategic priorities and goals. Instead of relying only on traditional budgeting methods that may be based on historical spending patterns or incremental adjustments, priority-based budgeting seeks to allocate resources based on the importance of various programs, services, or initiatives. As such, PBB employs an open and transparent process to ensure city funding is allocated to community priorities as expressed by City Council, the Mayor, as well as residents that are invited to participate and make their voices heard. Using this information, the City will reallocate resources from low-alignment programs to high-alignment programs, while also addressing existing critical needs and fiscal challenges.

For more information on the budget, click on each expandable section below:

Operating Budget

The City's Operating Budget is a flexible spending plan which serves as the legal authority for departments to commit financial resources. The budget sets forth a strategic resource allocation plan that addresses the City Council’s Strategic Goals. The Budget is a policy document, financial plan, operations guide, and communication device all in one. Through this document, the City demonstrates accountability to its residents, customers, and community-at-large.

The operating budget details the funding for the day-to-day operations and obligations of the City for each specific fiscal year, including costs for personnel, vendors and contractors, utilities, building maintenance, and debt payments. Every effort has been made to present the budget document in a user-friendly format with emphasis on trends and written explanations.

Capital Improvement Program (CIP)

The City of Riverside prepares a CIP document, which is different from the Operating Budget document, but the two are closely linked. The CIP is used as a planning tool to align capital project requirements to the financial sources that will support their realization and the timeframe in which both financing and work will take place. The first two years of the CIP are referred to as the capital budget and consist of the planned expenditures for the first two fiscal years in the CIP. The Capital Budget is part of the Biennial Budget, which appropriates funds for specific programs and projects.

A capital project typically involves the purchase or construction of major fixed assets such as land, buildings and any permanent improvement including additions, replacements and major alterations having a long life expectancy. Additionally, capital projects may apply to:

- Expenditures which take place over two or more years and which require continuing appropriations beyond a single fiscal year.

- systematic acquisitions over an extended period of time or

- scheduled replacement or maintenance of specific elements of physical assets.

Generally, only those items costing $20,000 or more are considered as capital projects. For informational purposes, capital projects are also referred to as capital facilities, CIP projects and capital improvement projects. The five-year CIP is reviewed annually to enable the City Council to reassess projects in the program.

Schedule of Fees & Charges

On an annual basis and in conjunction with the budget process, the Budget Office compiles all active and previously approved fees and charges into a single publication titled “Schedule of Fees and Charges”. Following Council review in June, the updated schedule is made available to the public via the City’s website at: Fees & Charges Page

If new fees or revisions to existing fees are requested by City departments during this same timeframe, those requests are presented at a public hearing conducted by the City Council; if approved by the City Council, the fees are added to the Schedule of Fees and Charges.

The FY 2022/23 Master Fees and Charges Schedule includes all fees and charges previously approved by Council action or proposed for approval through May 17, 2022, and excludes fees no longer being charged.

Learn More & Become Involved

The City’s Operating Budget and Capital Improvement Program documents, in partnership with the City’s Budget Transparency Portal ,advances our commitment to be more transparent and accountable to the Riverside community. These valuable tools aid the community’s understanding of the infrastructure priorities, successes and challenges that face our City in the upcoming fiscal cycle.

Throughout the fiscal year, the Budget Office prepares and presents quarterly Financial reports to the Budget Engagement Commission and City Council. These reports detail the year-to-date financial performance of the City’s major funds (General Fund, Measure Z, Electric, Water, Refuse, and Sewer) and summarize the year-to-date financial activity of items funded by Measure Z. At that time, the community learns about areas of fiscal concern that may influence the City’s financial health as well as budget adjustments or supplemental appropriations that may be recommended and approved. The community can learn about the budget, quarterly reports and other areas of the City’s finances by attending meetings of the Budget Engagement Commission, Financial Performance and Budget Committee, and City Council either in person or online, or watching recordings of past meetings.

Budget Reports

2024 - 2026

| Biennial Budget | Budget in Brief | |

| FY 2024-2026 Cost Allocation Plan | Capital Improvement Plan |